Global trading is expanding vastly, making it possible for Indian traders to trade US markets like the S&P 500 or Nasdaq using international brokers without their location. Providing access to various other assets is a great way to expand your portfolio beyond the local market.

But the accessibility to these markets isn’t the same for everyone. Many jump in without understanding the structure of timing, US volatility, or the cross-border rules. This often leads to inconsistent results and risks that could easily be avoided.

In this blog, we’ll see how you can trade at the right timing and volatility while following the compliance rules.

Quick Summary

| Aspect | Key Insight |

| Core Topic | Trading US indices from India is legally accessible but structurally complex |

| Popular Indices | S&P 500, Nasdaq 100, Dow Jones |

| Timing Challenge | US market hours India fall late at night |

| Key Risk | Volatility during overlapping global sessions |

| Regional Context | Indian and Vietnamese traders face similar timing and compliance issues |

| Compliance Angle | Broker structure, reporting, and documentation matter |

Understanding US Indices: A Structural Overview

Before getting to started with trading US indices from India, first try to understand what they actually track.

What Are US Indices?

They follow the performance of the world’s large companies:

- S&P 500 – Broad representation of US large-cap companies

- Nasdaq 100 – Technology and growth-heavy index

- Dow Jones Industrial Average – Price-weighted blue-chip index

Unlike Indian indices, US indices are deeply influenced by:

- Global capital flows

- Institutional derivatives

- Economic data releases

This is why the US index market behaves differently from index trading India.

- Through offshore brokers (CFDs) – Many traders use foreign platforms to trade US indices like Dow or Nasdaq as CFDs. It’s easier to start and needs less capital, but it’s not on Indian exchanges.

- Through US futures (CME) – Some serious traders open international accounts and trade E-mini or Micro index futures. This needs proper margin and a funded overseas account.

- Through US ETFs – Investors looking at the long term buy index ETFs through international brokers under the LRS route instead of actively trading.

Why Indian Traders Look at US Indices

The US market attracts more Indian traders due to a few practical reasons:

- Direct exposure to global economy trends

- Indices packed leading tech giants

- Higher volatility

- high-volume trading

But there’s a catch: you have to follow the US trading hour in India.

US Market Hours India: The Core Challenge

Timing is the biggest challenge traders face while trading US indices from India.

Official US Market Hours

The New York Stock Exchange and Nasdaq operate roughly during:

- 9:30 AM – 4:00 PM Eastern Time

For Indian traders, this translates to

- 7:00 PM – 1:30 AM (IST) during non-DST

- 6:30 PM – 1:00 AM (IST) during DST

In such a massive time difference, someone sticking to the screen for the whole time can feel exhausted, and it might lead to inconsistent results.

Therefore, a fixed timing that suits your trading style and helps you achieve your desired result.

Why Timing Matters More in US Index Trading

Many traders assume that if the market is open, then they should continue trading throughout the sessions. If you’re entering the US market, then you must know exactly where the real action happens.

Why US Index Volatility Is Time-Dependent

- Opening hours digest the overnight global news

- Institutional orders gets triggered in early sessions

- Major economic reports drop at fixed times

This shows that US market hours in India aren’t equally effective for all strategies.

Key Trading Windows Within US Market Hours India

1. US Market Open (Evening India Time)

This is one of the most active periods for trading US indices from India.

Why the Open Matters

- Prices react to overnight global news.

- Big institutions place their orders

- Volatility spikes

Practical Implication

Most experienced traders prefer this time slot, but sometimes it can be challenging due to high price swings. It is often compared to the Indian market open for index trading in India, but with higher global sensitivity.

2. Mid-Session US Trading (Late Evening India Time)

This phase often sees:

- Reduced volatility

- More stable price action

This session hits at midnight for Indian traders, which leads to fatigue and the risk of making mistakes, a very risky but real factor in trading US indices from India.

3. US Market Close (Early Morning India Time)

The closing hour can show:

- Position adjustments

- Short-covering

- End-of-day volatility

However, for most Indian traders, staying alert during this late is quite difficult.

Comparison: US Indices vs Index Trading India

| Factor | US Indices | Indian Indices |

| Time Zone | Night (IST) | Daytime (IST) |

| Global Influence | Very high | Moderate |

| Volatility | Session-clustered | Event-driven |

| Retail Participation | Lower relative | Higher |

This comparison explains why US indices require different timing discipline than index trading in India.

Regional Perspective: India and Vietnam Traders

Traders from Vietnam also face the same challenge as Indian traders:

- US markets opens at night

- Trading overlaps with personal downtime

- Risk of making mistake

For both, the secret is picking a few specific time slots rather than trying to trade all night long.

Risk Factors Specific to Trading US Indices from India

1. Overnight Trading Fatigue

Late-night trading leads to:

- Slow actions

- Emotional decisions

- Execution mistakes

2. News-Driven Volatility

US indices react sharply to:

- Fed announcements

- Inflation data

- Employment reports

These big events mostly take place after midnight in India, catching us unprepared for the next move.

Compliance and Documentation Considerations

According to legal rules, trading US indices from India is more than just market access.

Key Things to Watch

- Your broker’s location

- Specific type of derivatives

- Your trades record and timing

- Tax reporting duties

Why Regulators Care About Cross-Border Index Trading

What regulators expect from traders:

- They want clear and transparent transactions

- Proper reporting of any income earned from abroad

- Solid audit for your derivative trades

All you need to do is keep your records accurate and perfectly in sync with the actual exchange timing while you are trading US markets from India.

Tools That Help with US Index Trading Timing

Here’re some tools that support you by:

- Watching volatility by hour

- Keep in mind for any economic event

- Track how each session performs

These tools will reduce your risk and help you grab the best trading opportunities.

Why Fewer Trades Often Work Better

The key to success in trading is not a lot of trades at once; it’s just having control over the trade, not the opposite.

- Few, high-quality trades

- Better alignment with liquidity

- Reduced fatigue

This is a major shift in the mindset of traders is often seen in Indian index trading.

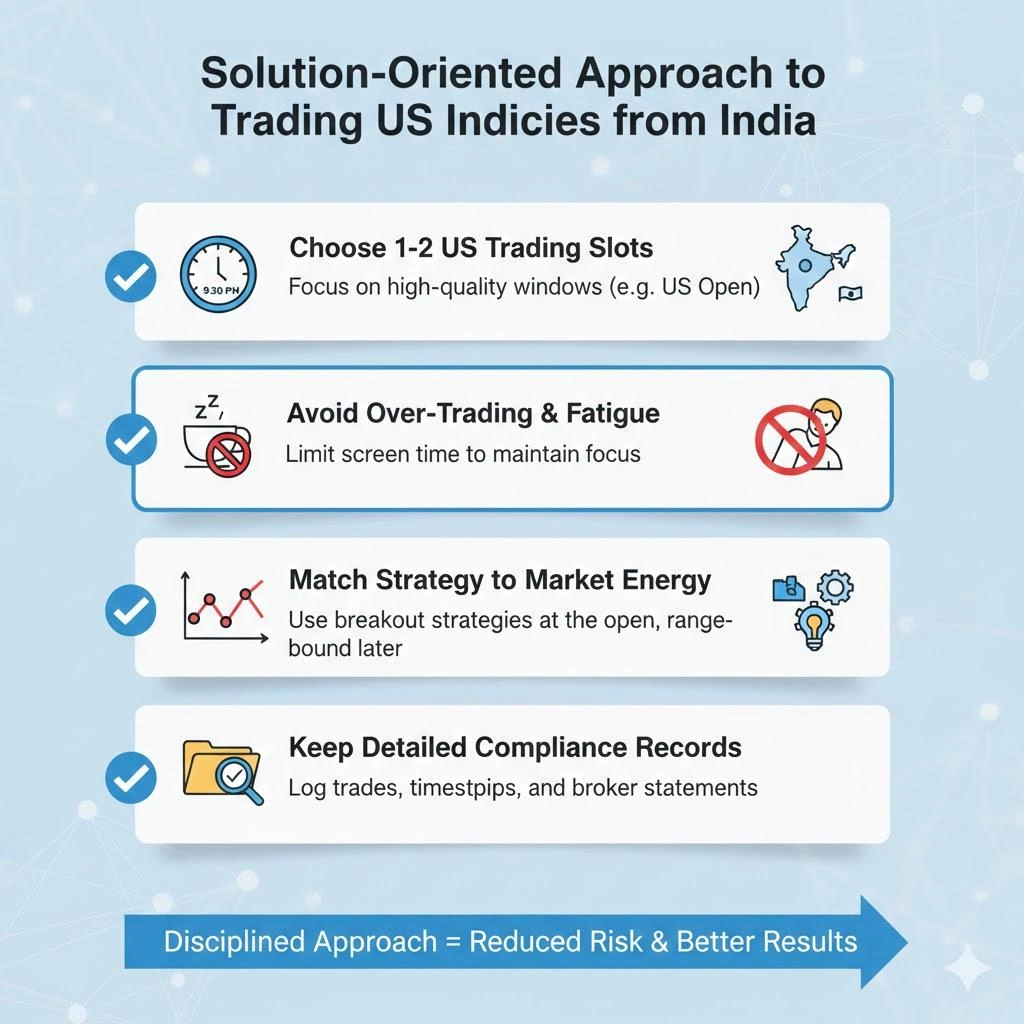

Solution-Oriented Approach to US Index Trading

Instead of looking for indicators that support US indices, try finding the most suitable time that matches your training style and helps you focus and manage risk.

Practical Steps

- Choose 1–2 US trading slots

- Avoid overtrading

- Match your strategy to the market energy

- Keep detailed records

This ensures that trading US indices from India stays a disciplined, structured activity rather than an impulsive choice.

Conclusion

Trading US indices from India gives you access to the global market, but it also requires serious timing discipline, market knowledge, and compliance awareness. Because of the different timing, volatility, and trading rules, you can’t treat the US market as an extension of local trading.

For traders in India and Vietnam, success is not just about being more active but also knowing exactly when the market offers opportunity, with utmost clarity and control. Connect with Insightful Trade; they make it easy for traders to analyze session habits, manage timing and risks, and keep your records for international trading.

FAQs: Trading US Indices from India, Tools & Compliance

1. Is trading US indices from India allowed?

Yes, you can trade US indices from India; you’ll just need an international broker and to follow the compliance and tax rules.

2. What are the most active US market hours in India?

The actions are at their peak when the US market opens, which happens in the evening for us here in India.

3. Is US index trading riskier than index trading in India?

Definitely, there are some risks present as you are dealing with a globally sensitive market and the challenge of long hours of trading.

4. Are tools available to track US market timing?

Yes, analyzing the present volatility, session overlaps, or any happening economic event, you can track the US market.

5. Does US index trading require special compliance attention?

Yes, even if you’re trading across borders, you need to maintain records, your broker proofs, and profit earned reports.

Author: Kumkum Chandak

Experience: 3+ Years in Trading Research & Market Content Strategy

Kumkum Chandak is a trading content strategist and market research writer who specializes in simplifying technical analysis, trading tools, and strategy-driven educational content. Her work is optimized for EEAT, accuracy, and user intent, ensuring every article delivers practical insights for traders of all levels.

Risk Disclaimer:

All content is strictly educational and not financial advice. Trading involves substantial risk. Always perform your own analysis or consult a professional advisor.

Last Updated: 6 February 2026