Quick Summary

Indian traders in Vietnam forex find themselves at the meeting point of two sets of rules: India’s FEMA and RBI laws and Vietnam’s own currency controls. The ability to trade across the borders provides them flexibility and better access, but it also brings up serious questions about legality, tax residency, and the need for proper records.

In this blog, we’ll learn how the laws of both India and Vietnam view these traders and why they face compliance problems when trading outside their countries, and we’ll provide steps to handle trading activities responsibly to avoid both legal and tax-related risks. This guide applies to Indian citizens temporarily or long-term residing in Vietnam who actively trade or plan to trade forex using Indian or offshore accounts.

Snapshot Overview

| Aspect | India | Vietnam |

| Forex regulation | FEMA & RBI | SBV regulations |

| Retail forex status | Restricted | Grey area |

| Offshore trading | Non-compliant under FEMA | Unregulated |

| Tax focus | Global income | Residency-based |

| Documentation importance | Very high | High |

The Core Problem: Why Indian Traders in Vietnam Forex Face Confusion

As terms of work from home and moving abroad are becoming common, many traders are also relocating for the short or long term. This has raised major question of concern:

“Can Indian traders legally trade forex while living in Vietnam?”

The confusion for Indian traders in Vietnam forex is happening because:

- Trading apps are accessible from anywhere

- Vietnam lets foreign platforms operate under the radar

- Indian FEMA rules floors your residency, not just your location

- Tax laws operate independently of trading legality

Many traders think that if they move to foreign land, it will cancel their Indian legal duties. This simply isn’t true.

Understanding the Two Legal Systems at Play

To assess Indian traders in Vietnam forex, both jurisdictions must be considered separately.

India’s Perspective

India manages forex trading through:

- FEMA (Foreign Exchange Management Act)

- RBI rules

- Income Tax Act

India focuses on:

- Residency

- Currency movement

- Capital account controls

Vietnam’s Perspective

Vietnam manages forex trading through:

- State Bank of Vietnam (SBV)

- Currency control regulations

Vietnam focuses on:

- Who is providing the trading services

- Money flowing in and out of the country

- Ensuring only licensed banks involved

The risk lies where these two different systems overlap. As per FEMA guidelines and RBI’s permitted currency framework, resident Indians are allowed to trade only INR-based currency pairs on recognized Indian exchanges through SEBI-registered brokers.

Does Living in Vietnam Change FEMA Obligations?

This is the biggest point of confusion for Indian traders in Vietnam forex. This is where many overseas traders get it wrong—changing countries doesn’t automatically change your legal identity under Indian law.

Key Principle

FEMA follows your residential status, not physical location.

If you are:

- An Indian resident under FEMA

- Using Indian funds

- Maintaining Indian bank accounts

Then FEMA rules apply, even if you are trading overseas.

Living in Vietnam does not automatically convert you into a non-resident under FEMA.

Residency vs Location: Why the Difference Matters

FEMA Residency

Defined by:

- How long you stay away

- Your reason for travelling

- Your plans (work or business)

Short trips, digital nomad visas, or traveling quite often won’t change your status as an Indian resident. This is why many people trading from abroad often break these rules.

Forex Trading Options Available to Indian Traders

1. Trading INR-Based Pairs (Compliant)

These are the currency pairs allowed to Indian residents for trading:

- USD/INR

- EUR/INR

- GBP/INR

- JPY/INR

But only:

- Under the supervision of Indian exchanges

- Through SEBI-registered brokers

This is true for Indian traders in Vietnam forex.

2. Trading Non-INR Pairs (Non-Compliant Under FEMA)

But many abroad-based brokers allow the trade of:

- EUR/USD

- GBP/USD

- USD/JPY

Trading these means breaking the rules made by FEMA for residents, no matter your location. This is a major risk factor for trading overseas.

Offshore Brokers and Vietnam: Why It Feels Easier

In Vietnam restrictions against offshore brokers are not that strict, which creates a false sense of legality.

For Indian traders in Vietnam forex:

- Apps are easy to access

- Payments seem simple

- No one seems to be watching

But the lack of enforcement doesn’t mean it’s allowed. Your duties as an Indian resident still exist.

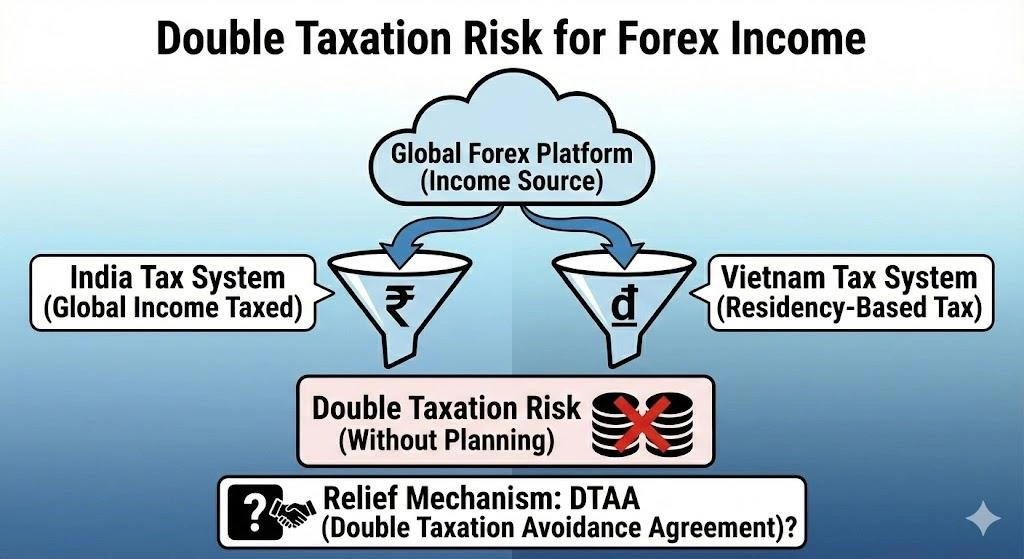

Tax Implications for Indian Traders in Vietnam Forex

Taxation is separate from FEMA.

Indian Tax Perspective

If you are:

- An Indian tax resident

- Or earning money from India

Then your profits are likely to be taxable in India, even if you’re trading while abroad.

Vietnam Tax Perspective

Vietnam taxes are based on:

- Residency

- Income source

As per Vietnam’s SBV foreign exchange controls, short-term visitors don’t have to pay local tax on offshore trades, but it depends on your visa and how long you stay. There is a real risk of being taxed twice if you don’t plan your trips properly.

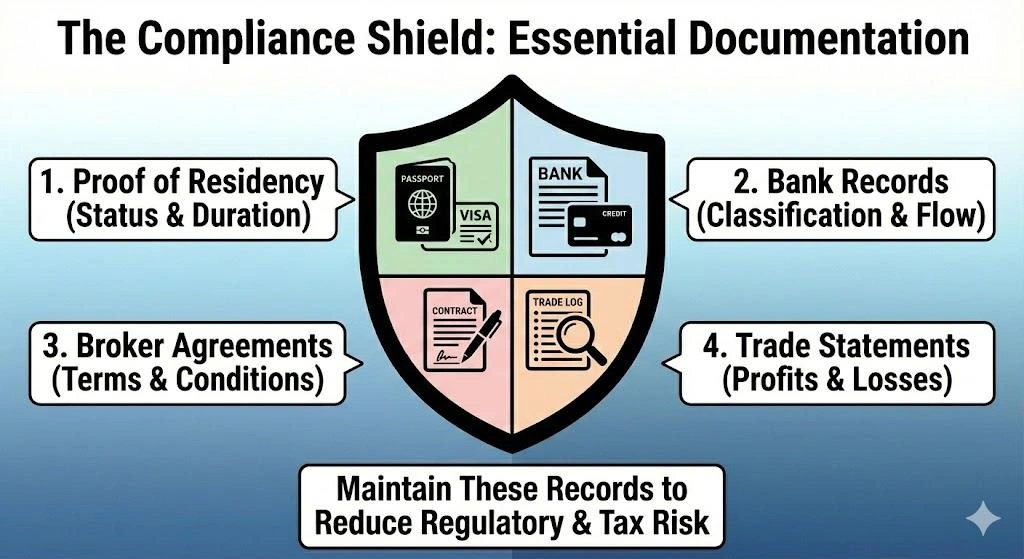

Documentation: The Core Compliance Shield

If you’re Indian traders in Vietnam forex, keeping records of your trades is an essential.

Key Records to Maintain

- Proof of your residency status

- Bank account classification

- Signed contract with broker

- Trade statements

- Fund flow records

Documentation helps show the intent behind your actions, which regulators often consider.

Banking Scrutiny and Forex Abroad India

Banks act as your early sign of warning.

Common Triggers

- Frequent international transfers

- Large cash withdrawals

- Vague purpose for payments

Even if you trade abroad, Indian banks can still question you for any money you sent home.

Why Many Traders Get Caught Unintentionally

Most legal issues occur due to:

- Thinking that offshore trading means freedom from taxes

- Overlooking residency definitions

- Mixing personal and trading funds

- Trusting too much in broker’s marketing claims

These mistakes are common to those who are new to trading overseas.

Can Indian Traders Legitimately Trade Forex Abroad?

Yes, but only if you execute it following the rules.

Key Requirements

- FEMA non-resident status

- A bank account based abroad

- Clear source of funds

- Right tax category

Without these, trading from abroad can be risky.

Why Regulators Focus on Capital Movement, Not Location

Regulators only focus on:

- Money leaving the country

- Keeping economy stable

- People dodging the rules

They don’t care where you are buying or selling. This explains why Indian traders in Vietnam Forex stay on their radar.

Future Outlook for Indian Traders Abroad

As more people move around:

- Countries will share more data

- Banks will get more transparent

- Unofficial trading will be watched

By this you can assume that in the future rules will get stricter, not easier. Forex regulations and tax treatment can vary based on individual residency status, visa type, source of funds, and duration of stay abroad.

Conclusion

Indian traders in Vietnam forex follow two different legal systems, making it more complex than trading back home. In Vietnam the trading environment is quite bearable related to foreign trading apps, while India’s FEMA and RBI rules still apply based on where you reside, not where you’re located. Therefore, trading from abroad will not exempt you from your Indian legal or tax duties. Those who understand the structure and keep their paperwork organized are in a much better position to handle the risk responsibly.

For more updates on global compliance and trading trends, connect with Insightful Trade, which provides research-oriented data to help you navigate these tricky complexities with clarity.

Frequently Asked Questions (FAQs)

1. Can Indian traders legally trade forex while living in Vietnam?

Only if FEMA non-resident status and proper structuring are in place.

2. Does trading overseas remove FEMA obligations?

No. As per the FEMA section, it applies based on all Indian residency, not physical location.

3. Are tools like MT4 or MT5 illegal for Indian traders?

No. Tools are neutral; legality depends on how and where they are used.

4. Is forex income taxable for Indian traders abroad?

Yes, depending on tax residency and income classification.

Author: Kumkum Chandak

Experience: 3+ Years in Trading Research & Market Content Strategy

Kumkum Chandak is a trading content strategist and market research writer who specializes in simplifying technical analysis, trading tools, and strategy-driven educational content. Her work is optimized for EEAT, accuracy, and user intent, ensuring every article delivers practical insights for traders of all levels.

Risk Disclaimer:

All content is strictly educational and not financial advice. Trading involves substantial risk. Always perform your own analysis or consult a professional advisor.

Last Updated: 3 February 2026