Index trading is one of the most preferred trading styles in India, with NIFTY 50 and BANK NIFTY attracting massive daily volumes. Often traders struggle with bad strategies, but the main reason for trade failure is poor time management.

The real effect in trading comes from perfect timing. As the market is moving, there are times when bigger aspects affecting trading gather around, like liquidity, volatility, institutional activity, and global cues, all at a specific time window.

In this blog, we’ll learn how the Indian index trading times work and why certain hours work better, not just listing time slots.

Quick Summary

| Aspect | Key Insight |

| Core Focus | The best trading hours for Indian index traders depend on volatility and liquidity |

| Key Indices | NIFTY 50, BANK NIFTY, FINNIFTY |

| Critical Factor | Market timing India affects risk more than strategy |

| Global Influence | Asian & US markets indirectly impact Indian indices |

| Trader Type | Timing differs for scalpers, intraday traders, and positional traders |

| Compliance Angle | Exchange hours and documented trades matter |

The best trading hours for Indian index traders are typically

- 9:15–10:15 AM (opening volatility)

- 1:30–3:30 PM (trend continuation and closing momentum)

Midday sessions often see lower participation and reduced directional strength.

Understanding Indian Index Trading Basics

Before we find the best timing for trading in India, let’s see how Indian indices actually function.

What Are Indian Indices?

They are essentially baskets of stocks:

- NIFTY 50 – Broad market representation

- BANK NIFTY – Banking and financial sector focus

- FINNIFTY – Financial services beyond banks

Since index derivatives (F&O) are the most popular tool in India, getting the timing correct is very important, especially for intraday traders.

Why Market Timing Matters More Than Strategy

Traders are so obsessed with indicators and patterns that they forget if the timing is not right, even the best setup can behave differently.

Why Timing Changes Outcomes

- Cash flow fluctuates throughout the day

- Big institutions trades at specific hours

- Volatility expands and shrinks

- Option premiums decay at an uneven rate

Knowing the best trading hours for Indian indices will help you avoid the unnecessary rumors, get the best trading cost, and make a much calmer decision.

Official Index Trading Time India

Indian equity markets operate as follows:

- Pre-open: 9:00 AM – 9:15 AM

- Regular session: 9:15 AM – 3:30 PM

Even though the market operates for over six hours, not all hours are equally effective for index trading.

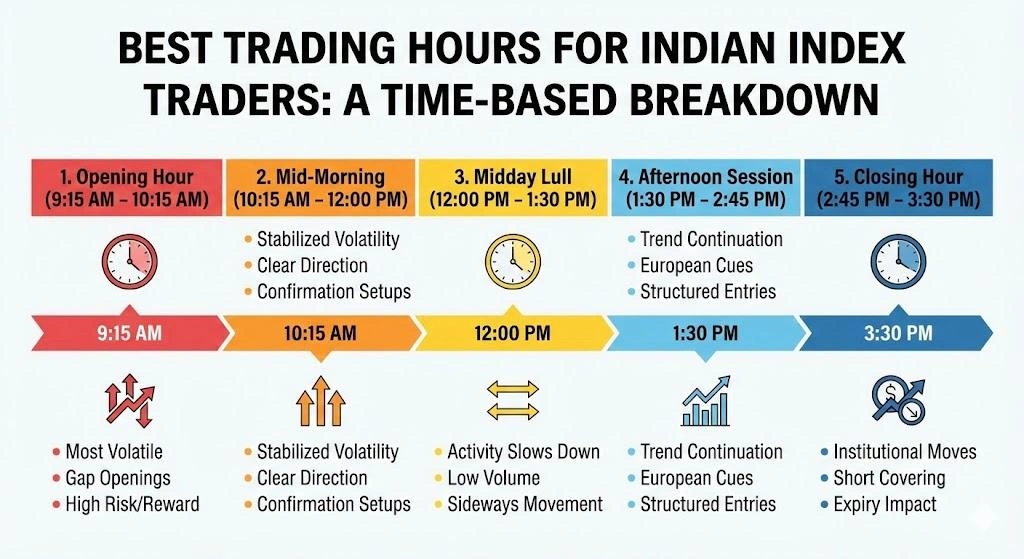

Best Trading Hours for Indian Index Traders: Time-Based Breakdown

1. Opening Hour (9:15 AM – 10:15 AM)

This is the best time to trade in India, especially for F&O, but also one of the riskiest.

Why This Hour Matters

- Most volatile and traded session

- Trading reacting to news released overnight

- Big funds enter the market

Practical Insight

- Best for experienced traders

- Ideal for breakouts and gap openings

- Strict risk control

This is a very important Indian market timing and can be a bit emotionally exhausting for beginners.

2. Mid-Morning Session (10:15 AM – 12:00 PM)

This period is often ignored due to low volatility, but it’s a vital part of index trading time in India.

Why Volatility Stabilizes

- The market rush settles down

- The direction looks clear

- Option premiums normalize

Who This Time Suits

- Best for intraday traders

- Traders looking for confirmation

- Low stress than the opening

3. Midday Lull (12:00 PM – 1:30 PM)

Here the market starts losing its energy and slows down for a while. It’s known as low-quality trading time.

Why Activity Slows Down

- Institutional desks reduce activity

- Retail participation declines

- Volatility dries up

At this timing you’ll often find:

- False breakouts

- Boring movement

- Option prices losing value without direction

Most disciplined traders simply choose to step away from the screen during this slot.

4. Afternoon Session (1:30 PM – 2:45 PM)

Here’s when the momentum starts regaining its strength in the Indian index markets.

Why It Matters

- Traders start adjusting their positions

- Cues from the European market begin to sway the market.

- Clear trend continuation starts to appear

It’s the perfect time for a trader who missed an early morning opportunity but is still looking for a solid, structured entry.

5. Closing Hour (2:45 PM – 3:30 PM)

This is the time for the final decision after analyzing the move for the whole day; here the decision you make can impact your tomorrow’s results. It’s another best trading hour for Indian index traders.

Why the Close Is Important

- Institutional book adjustments

- Short covering or fresh positions

- Options expiry impact

Here you will see sharp directional moves, making it a hotspot for experienced intraday traders.

Best Trading Hours by Trader Type

To master market timing in India, you need to match your trading window to your trading style.

Scalpers

- Best time: 9:15 AM – 10:00 AM

- Reason: High liquidity and volatility

Intraday Trend Traders

- Best time: 10:15 AM – 12:00 PM and 1:30 PM – 2:45 PM

- Reason: Cleaner price action

Option Sellers

- Best time: After 10:30 AM

- Reason: Volatility contraction and theta decay

This exactly explains why the same index can feel like a totally different scenario depending on the time of day.

How Global Markets Influence Indian Index Timing

The global market also has a great influence over the Indian indices market, like.

Asian Market Influence

- Early morning sentiment

- Regional risk appetite

European Market Influence

- Afternoon volatility pickup

- Currency and bond cues

The Indian market is highly sensitive to the U.S. market, especially on the next day’s open after a news release overnight; this is why picking the right best trading hours for Indian index traders is crucial.

Common Mistakes in Index Market Timing

- Trading throughout the day without any adjustments

- Thinking high volatility will always bring opportunities

- Trading during middays when the market is dull

- Over-trading when the market quality is low

Most of the time losses happened due to these several reasons, not necessarily a bad strategy.

Why Exchanges and Compliance Care About Timing

From a legal perspective, it is important to follow the rules provided by the exchange to stay on the right side of the law:

- Trades must happen during official exchange hours

- Should have order timestamps

- Audit trails rely on session validity

Understanding the index trading time that’s most suitable for Indian traders will help:

- Maintaining records

- Avoid execution disputes

- Align with regulatory expectations

Tools That Help Analyze Market Timing India

Here’re few tools that assist traders with:

- Highlighting volume trends by time

- Predicting high volatility presence

- Analyzing your performance at the end of session

These tools are there to save your time and make things easy for you, but they don’t replace your own judgment.

Solution-Oriented Approach to Market Timing

To find yourself the best trading time that suits your trading style.

Practical Steps

- Track trades by time

- Try to find the most profitable window

- Avoid low-volume sessions

- Focus on reliable schedule

This disciplined approach will help you identify the best trading hours for Indian index traders.

Conclusion

To wrap it up, there’s no fixed trading time that is considered to be perfect, but they are never random. Things like volatility, volume, and big bank intervention create special advantages in the market that a smart trader learns to utilize with time.

Mastering Indian index timing and following a structured approach cuts out unnecessary risk and builds consistency, especially for those trading across different regions like India and Vietnam.

If you want help with analyzing your performance, managing time and risks, and basing your trades on real data-driven logic, then connect with InsightfulTrade.

FAQs: Best Trading Hours, Tools, India & Compliance

1. What are the best trading hours for Indian index traders?

Mostly it’s 9:15–10:15 AM and 1:30–3:30 PM; otherwise it depends on your strategies and experience.

2. Is midday a good time for index trading?

Middays are considered to be calm and less volatile; therefore, they are less ideal for intraday traders.

3. Does index trading time in India differ for options and futures?

Yes, most F&O traders prefer the opening sessions due to high price movement and active trades.

4. Are there tools to analyze market timing in India?

Yes, you can use volatility and volume to find out the best time to trade your setups.

Author: Kumkum Chandak

Experience: 3+ Years in Trading Research & Market Content Strategy

Kumkum Chandak is a trading content strategist and market research writer who specializes in simplifying technical analysis, trading tools, and strategy-driven educational content. Her work is optimized for EEAT, accuracy, and user intent, ensuring every article delivers practical insights for traders of all levels.

Risk Disclaimer:

All content is strictly educational and not financial advice. Trading involves substantial risk. Always perform your own analysis or consult a professional advisor.

Last Updated: 6 February 2026