Quick Summary

Most of the traders spend their time trying to guess the next move of the market, thinking that being right is the secret to making money. In reality, people lose trades all the time even when they guess the direction correctly. The reason behind this is bad timing. The whole timing vs direction debate reveals a truth most people miss: when you get into a trade matters more for your risk and consistency than where the price eventually ends up. In this blog, we’ll try to understand why entry timing is so important, how it can ruin a good trade, and how you can stop trying to predict the market and start focusing on better execution.

Trade Timing vs Direction: At-a-Glance Comparison

| Factor | Direction-Focused Trading | Timing-Focused Trading |

| Core Question | Where will the price go? | When should I enter? |

| Risk Exposure | Often higher | More controlled |

| Drawdowns | Larger and longer | Typically smaller |

| Emotional Stress | High | Lower |

| Entry Timing Forex Relevance | Low | High |

| Trade Timing vs Direction Outcome | Inconsistent | More stable |

The Core Problem: Why Traders Obsess Over Direction

Most trading courses start with how to pick a direction:

- Finding the trend

- Deciding on support and resistance

- Looking at the big picture

Well, the direction is important, but it’s not the only indicator of the markets’ next move. Many traders deal with the same frustrating experience: the price went exactly where I thought it would, but I still lost money. This is the core of the timing vs direction problem.

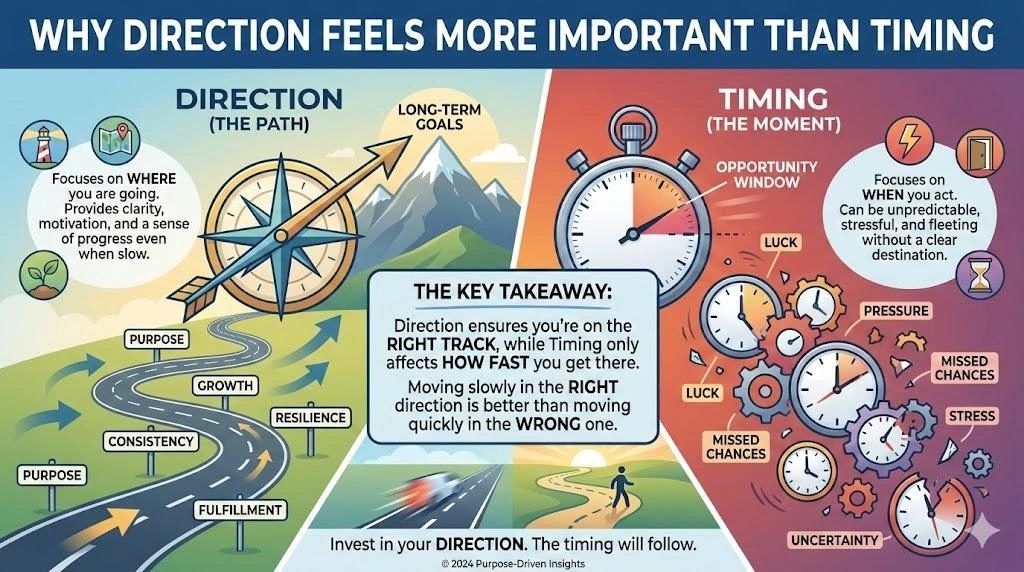

Why Direction Feels More Important Than Timing

Focusing on direction feels natural because:

- It matches with your instinct

- It creates a clear story in our head

- It makes decisions same easier

But the market isn’t just about where the price goes; it’s about how it gets there. Your entry timing is what decides if your trade can survive in the market long enough for your idea to actually come true.

Entry Timing Forex: Why Timing Controls Risk

In Forex, your entry time decides:

- How far your stop loss needs to be

- How big of a trade size you can take

- Your overall risk-to-reward ratio

Two traders can both be right about where the market is headed, but only one might end up winning all because of their timing.

Practical Example: Same Direction, Different Timing

Scenario

EUR/USD is clearly moving upward.

Trader A (Direction-Focused):

- Buy the second they see the uptrend

- Unfortunately they buy near a resistance

- They need a huge stop-loss to stay in the trade

Trader B (Timing-Focused):

- Wait for the price to dip a bit

- Gets in once they see the price starts to turn back up

- Can use a much tighter stop lost

Both of them were right about the direction, but trader B is in a much better spot because their timing was better

Why Poor Timing Amplifies Losses

Bad entry timing leads to:

- Having to use much bigger stop losses

- Not being able to trade as much you like

- Feeling way more stressed

If you miss the timing by even a small amount it can kick you out of a trade before your original Idea even has a chance to play out.

Trade Timing vs Direction in Ranging Markets

When the market isn’t trending:

- Trying to pick a direction is often a losing game

- Timing becomes everything

A trader who gets in at the very top or bottom of the range does well even if they aren’t sure where the price will eventually go. This shows how timing can become even more important depending on what the market is doing.

Why Entry Timing Forex Improves Risk-Reward

Better timing gives you:

- Tiny stop losses

- The chance for much bigger wins

- Needing fewer wins to make up for any loss

The unbalanced advantage is the main benefit of focusing on timing.

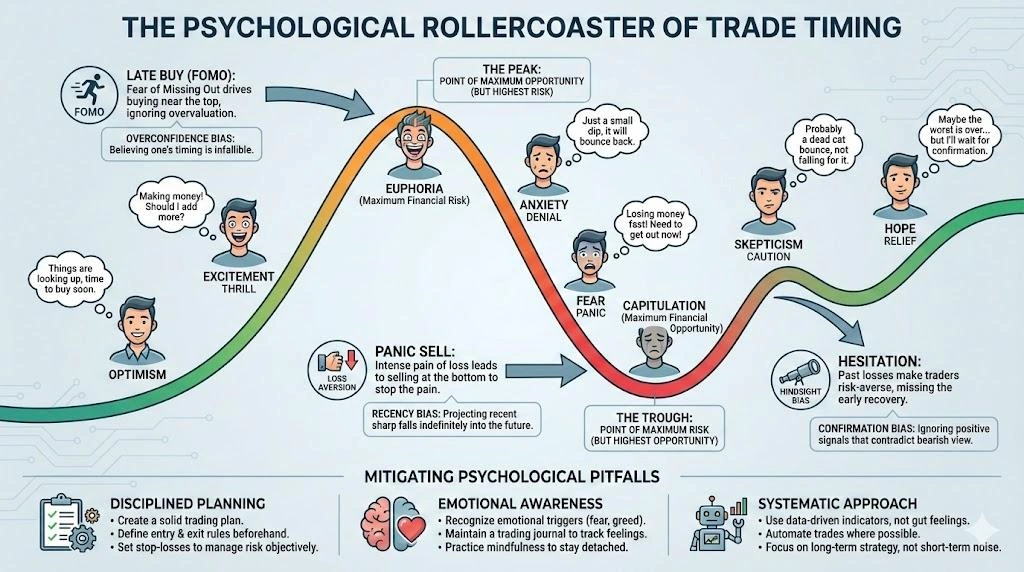

Psychological Impact of Trade Timing

- Good timing: Your trade starts off in profit faster, which builds your confidence and keeps you disciplined.

- Poor timing: It makes you stop trusting your own good ideas.

At the end of the day, timing vs direction is just as much a mental challenge as it is a technical one.

Indicators vs Timing Context

Indicators are usually all about directions:

- Showing you the trends

- Showing you the speed of the move

But good timing needs context, like

- When the market is getting quite before a big move

- When the actual orders are sitting

- The structure of the market

Good timing isn’t really about following a signal; it’s about putting your trade in the right spot at the right time.

Why Professionals Emphasize Timing

Professional traders often:

- Slowly build up their trade time

- Use timing to keep their risk under control

- Except that they won’t always be sure about the direction

The real secret is how well they execute the trades, not how well they can predict the future.

Trade Timing vs Direction in Strategy Design

A solid plan always has:

- An overall direction

- Precise rules for when to enter a trade

- A clear invalidation

Strategies that ignore timing often look like winners in a test but fail miserably in the real world.

Indian Market Context: Timing Sensitivity

Indian traders face:

- Wild price jumps at the market open

- Sudden moves during the day when news releases

- Strict limits on how much they can trade

Getting your perfect entry in the forex and index market is important because:

- You can get hit with bad price jumps

- Your orders might get delayed

- The broker has strict intraday risk rules

In these conditions, a small timing mistake can be very expensive.

Tools That Help Improve Entry Timing Forex

Helpful tools to use:

- Look at different timeframes for better understanding

- Indicators that show how much price is jumping

- Analysing the market based on different time of the day

These tools can help you make better timing decisions, rather than just trying to guess direction.

Common Myths About Trade Timing vs Direction

- Direction is the only thing that matters

- Timing only matters for people who trade super fast

- Timing means you’ll never lose a trade

- Timing is just random luck

- You can’t actually learn how to time your entries

Each of these myths misses the point: timing is an important tool for controlling your risk.

Shifting From Direction Bias to Timing Awareness

Practical steps:

- Deciding where you can go wrong before you enter

- Decide how much volatility you are willing to handle

- Wait for the price to come your safety zone

Doing this will help you improve your trading without having to change how you pick your directions.

Long-Term Consistency and Entry Timing Forex

You become more consistent when:

- Your losses are smaller

- Your dips in account balance are under control

- Your trade can survive the market’s normal up and downs

In the end, the balance between timing and direction helps you decide if your strategy will last long or not.

Conclusion

The whole debate over timing vs direction proves one simple thing: that being right just isn’t enough. While picking the right direction gives you a plan, your entry time is what actually decides the risk and state of mind. Most traders already have good ideas; they only struggle with just how and when to implement them.

By focusing on both timing and direction, you can avoid unnecessary losses and build a strategy that actually fits how the market moves. Sites like Insightful Trade focus on this execution-first mindset, helping traders make disciplined, well-timed decisions.

FAQs

1. Is trade timing vs direction relevant for Indian traders?

Definitely, the Indian market is sensitive to timing because of the volatility and all the different rules.

2. Does SEBI regulate trading strategies?

No, SEBI just wants you to be honest and clear about the risk you’re taking.

3. Can beginners focus on timing?

Yes, in fact, learning about timing early can help you avoid getting too obsessed with trying to predict the future.

4. Is direction still important?

Yes, it is, but you have to combine it with good timing if you want to keep your risk under control.

Author: Kumkum Chandak

Experience: 3+ Years in Trading Research & Market Content Strategy

Kumkum Chandak is a trading content strategist and market research writer who specializes in simplifying technical analysis, trading tools, and strategy-driven educational content. Her work is optimized for EEAT, accuracy, and user intent, ensuring every article delivers practical insights for traders of all levels.

Risk Disclaimer:

All content is strictly educational and not financial advice. Trading involves substantial risk. Always perform your own analysis or consult a professional advisor.

Last Updated: 24 January 2026