Quick Summary

Trading paralysis is a feeling where you hesitate to pull the trigger even when you see a perfect setup right in front of you. It happens when the market is fast and unstable, making uncertainty feel much more intense. This paralysis does not come from lack of strategy; it’s a natural fear of making wrong decisions and losing money. Understanding fear during volatility trading helps traders regain clarity, execute consistently, and reduce missed opportunities.

Trading Paralysis at a Glance

| Factor | Impact on Trader |

| Emotional trigger | Fear during volatility trading |

| Behavioral response | Hesitation or inaction |

| Trade execution | Missed or delayed entries |

| Confidence | Gradual decline |

| Long-term effect | Inconsistent performance |

What This Guide Covers

- What trading paralysis really means

- Why volatility triggers fear-based inaction

- The psychology behind fear during volatility trading

- Practical examples of trading paralysis

- Structural and psychological solutions

- Tools and habits that support clarity

- India-specific considerations and compliance

The Core Problem: Volatility Overloads Decision-Making

Markets are naturally unpredictable, but when the volatility increases, that not-knowing feeling hits even harder. When price swings fast or acts weird, your brain gets flooded with too many questions and a lot of pressure. This often leads to trading paralysis at that moment where you know exactly what to do, but your finger just can’t move.

It’s a mental hurdle, not a technical one. You see a great setup, but the danger suddenly feels much bigger than usual.

What Is Trading Paralysis?

Trading paralysis is a feeling where you are stuck and not being able to make your trading decisions due to some unknown fear, self-doubts, or maybe mental overload. It commonly happens because:

- Sudden market spikes

- News-driven sessions

- Breakouts and fast reversals

The main sign is simply staying inactive, even when you know exactly what you should be doing.

Why Fear Increases During Volatile Markets

Market volatility actually changes how your brain handles risk. When things are calm, it’s easy to stay logical. But once the volatility hits, your brain switches to survival mode.

This explains why fear during volatility trading:

- It feels stronger than your usual nerves.

- It drowns out your logical analysis.

- It makes your first instinct to just hide or do nothing.

The Brain’s Role in Trading Paralysis

When the market gets volatile, your brain starts panicking. Creating various scenarios in mind, in which:

- Your reaction slows down

- Your confidence decreases

- Decision-making becomes defensive

This is why trade paralysis isn’t just in your head; it’s a physical reaction where your body is telling you to stop and stay away.

Common Symptoms of Trading Paralysis

Traders stuck in paralysis often find themselves:

- Watching the price move while they just sit there

- Doubting a setup even when they look perfect

- Waiting for one more signal before pulling the trigger

- Feeling totally stressed out and overwhelmed

These are all very common reactions to the pressure of volatility trading.

Practical Example: A Volatile Market Scenario

Imagine you have been practicing a breakout strategy for a long time. You know it inside out. Then, a major news event hits:

- Price approaches the setup

- Volatility expands rapidly

- The trader hesitates

The trade goes exactly where you thought it would, but you’re not a part of it. This leaves you frustrated and doubting yourself, which only makes it harder to pull the trigger next time.

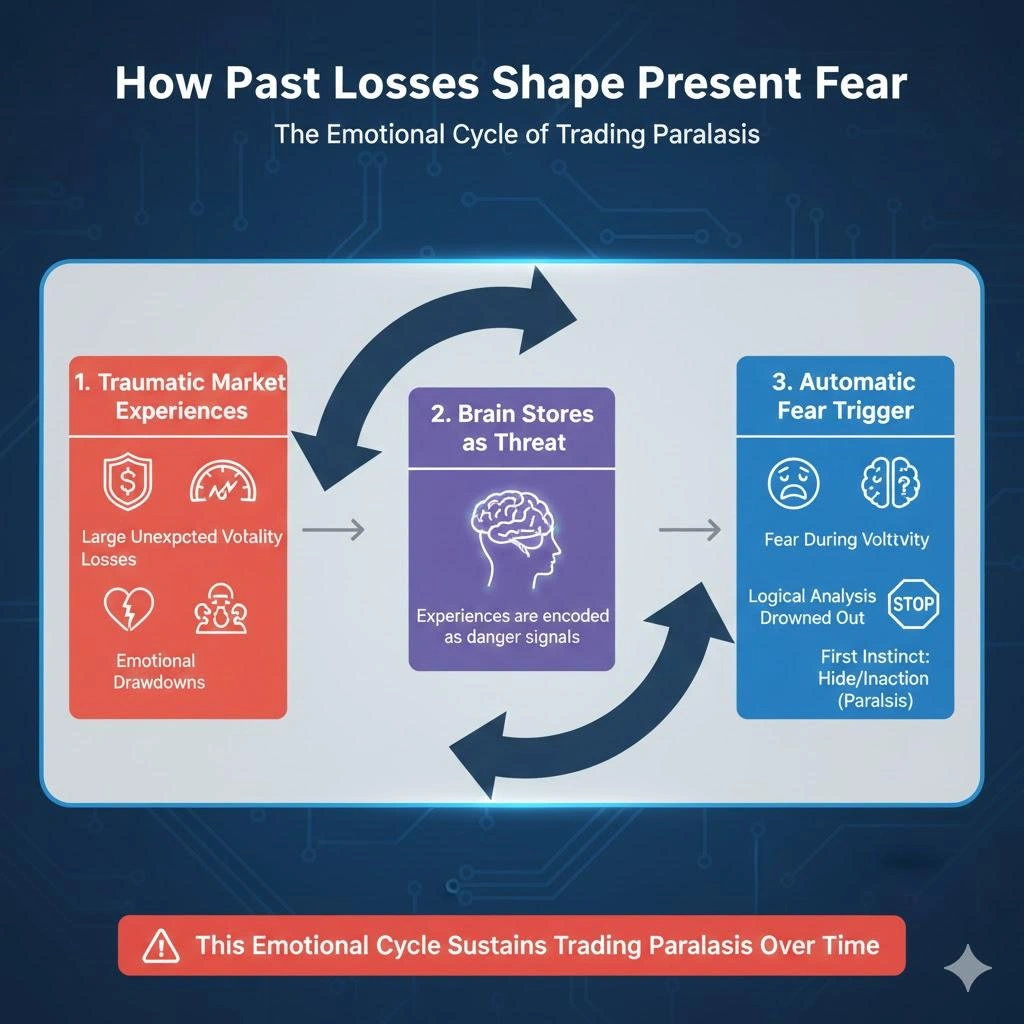

Why Missing Trades Feels Worse Than Losing

It’s a strange truth, but many traders find the pain of missing a great move much sharper than the sting of a loss. This is because:

- Missed trades create regret

- Regret reinforces fear

- Fear strengthens paralysis

This emotional cycle sustains trading paralysis over time.

The Illusion of Safety Through Inaction

Many times traders assume that if they don’t trade during high volatility, they’re safe. However:

- Inaction is still a decision

- It carries opportunity cost

- It damages confidence

Fear causes you to think that “waiting” is protection, even when it’s not.

How Past Losses Shape Present Fear

Trading paralysis often develops after:

- Large unexpected losses

- Slippage during volatility

- Emotional drawdowns

These past experiences get stored in your brain, and it automatically hits the panic button the second those same market conditions appear again.

Over-Analysis and Trading Paralysis

When we get nervous, our instincts automatically start looking for:

- More indicators

- More confirmations

- More opinions

This leads to analysis paralysis, where you’re so affected by the extra noises that your brain just gives up and shuts down.

Volatility Does Not Equal Randomness

We often mistake volatility with unpredictability, but they aren’t the same thing:

- Volatility follows structure

- Liquidity still exists

- Risk can still be defined

Once you realise that the market has its own structure and it follows it even during volatility, helps in restoring the lost confidence.

Structural Causes of Trading Paralysis

Psychological fear is often amplified by structural issues:

- No predefined risk limits

- Inconsistent position sizing

- Undefined volatility rules

Without structure, fear during volatility trading has more room to grow.

How Trading Plans Reduce Paralysis

A plan that’s made especially for when the market volatility is high. Its answers:

- When not to trade

- How much to risk

- What volatility conditions are acceptable

Having these rules reduces decision load, limiting trading paralysis.

Practical Solutions to Trading Paralysis

Step 1: Define Volatility Conditions in Advance

Know which market environments you will trade.

Step 2: Pre-Plan Execution Rules

Don’t try to make big choices. Just follow your rules and strategy.

Step 3: Use Fixed Risk Parameters

Use the same risk management rules every single time, it takes the weight off your shoulders. Consistency is the best cure to lower fear.

Step 4: Focus on Execution, Not Outcome

Stop obsessing over the final result. Instead, focus entirely on the process.

Journaling Fear Responses

Tracking when and why you get nervous helps you spot patterns. Your journals reveal:

- Emotional triggers

- Environmental factors

- Structural gaps

Over time, this awareness is exactly what helps you stay calm when the market gets volatile.

Tools That Support Clarity

No tool can delete your fear, but they can definitely help reduce the confusion:

- Volatility indicators

- Risk calculators

- Trade checklists

Using these tools, you can stay disciplined, especially when the market is moving at lightning speed.

When Not Trading Is the Right Choice

Don’t mistake being frozen for being disciplined. It’s actually a smart decision to stay out of the market if:

- Volatility to high

- Liquidity dries up

- Rules are violated

The real difference is making a conscious choice to set out rather than just being too scared to act.

Building Long-Term Confidence

Real confidence comes from within when you’re disciplined with your trading, following the rules. You can avoid market volatility and grab opportunities:

- Trading small during uncertainty

- Executing rules consistently

- Accepting incomplete information

This is how you can avoid trading paralysis.

Conclusion

Look, it’s very common that the human brain freezes in uncertain situations. The trading paralysis happens when the market is highly uncertain and you’re not confident enough to take a trade because you have fear of past losses. But if you want to continue as a trader, you need to overcome this feeling for proper trade execution, risk control, and decision-making.

If you want some counseling or guidance, you can visit platforms like InsightfulTrade. They provide expert guidance, and with their own experience, they can help you handle such situations with more confidence and clarity.

Frequently Asked Questions (FAQs)

What is trading paralysis?

It’s a frozen feeling where you can’t bring yourself to click the button out of fear or overthinking.

Why does volatility trigger fear?

Rapid changes create uncertainty, which triggers the brain’s natural danger alarm, making it difficult to follow logically.

Can tools help reduce trading paralysis?

Yes. With the help of certain tools you can prevent pressure and believe more in your strategies.

Is trading paralysis common among Indian traders?

Yes, due to capital sensitivity and regulatory concerns.

Does experience alone fix trading paralysis?

No. Structure and emotional awareness are also required.

Author: Kumkum Chandak

Experience: 3+ Years in Trading Research & Market Content Strategy

Kumkum Chandak is a trading content strategist and market research writer who specializes in simplifying technical analysis, trading tools, and strategy-driven educational content. Her work is optimized for EEAT, accuracy, and user intent, ensuring every article delivers practical insights for traders of all levels.

Risk Disclaimer:

All content is strictly educational and not financial advice. Trading involves substantial risk. Always perform your own analysis or consult a professional advisor.

Last Updated: 13 January 2026