Quick Summary

By understanding the broker execution models, you’ll be able to see why sometimes your results are different across platforms. While a lot of traders only focus on strategy or indicators, they often ignore how the broker actually executes their orders. You’ll notice how the slippage, spreads, and overall speed are influenced by different STP or market maker models. In this blog you’ll get the perfect explanation for all the models, showing how the system works, why it matters, and how you can manage execution risk more effectively.

Key Insights at a Glance

| Execution Model | How Orders Are Handled | Impact on Traders |

| Market Maker | Broker acts as counterparty | Fixed spreads possible, internal pricing |

| STP | Orders routed to liquidity providers | Variable spreads, external execution |

| ECN | Direct order matching network | Raw spreads + commission |

| Slippage | Depends on liquidity and routing | Affects real trade results |

| Transparency | Varies by model | Influences trust and compliance |

Why Broker Execution Models Matter

When traders analyze their performance, they often review:

- Entry timing

- Stop placement

- Strategy accuracy

When you really understand the broker execution model, you’re able to see the hidden process behind your trades.

Execution structure affects:

- Speed of fills

- Spread behavior

- Slippage frequency

- Conflict of interest perception

Due to incomplete knowledge, you’ll be left thinking it’s your strategy failure when in reality it was an execution fault.

What Are Broker Execution Models?

Broker execution models are the simple process of how the brokers handle and route your trades.

There are three common structures:

- Market Maker

- STP (Straight Through Processing)

- ECN (Electronic Communication Network)

The STP vs. market maker is very common, but ECN is usually paired with STP since both send the orders out to the global market. If you truly want to understand how the trades are filled, you need to start by understanding the models working.

Market Maker Model Explained

In a market maker model:

- The broker creates internal bid and ask prices

- The broker may act as the counterparty to your trade

- Orders may not be routed to external liquidity providers

This does not automatically mean unfair practices. Many regulated brokers operate as market makers responsibly.

How It Works

If you buy EUR/USD:

- The broker may sell to you internally

- Your profit becomes the broker’s liability

Because trades can be internalized, execution may be

- Fast

- Stable during normal conditions

- Fixed spread-based

However, you’ll still notice things like slippage and spreads in wild markets.

STP Model Explained

In the STP model:

- Orders go straight to external banks

- The broker doesn’t usually bet against you or take the other side

- They earn through small markups or flat commission

A big difference between STP and market makers is the process of them sending your trades.

How STP Works

- You place an order

- Broker forwards it to a liquidity provider

- Liquidity provider executes the trade

The spread amount can be different as it changes according to the market’s liquidity. STP brokers usually have fewer conflicts of interest than traditional market makers.

ECN Model Explained

ECN is a type of trading model that directly sends:

- Your orders get sent to a joint network

- You trade with banks, big funds and other traders

- Traders match based on the best pricing and timing

ECN typically offers:

- Tight spreads

- Direct market access

- Separate commission fees

The ECN is often grouped with STP together as non-dealing desk options.

STP vs Market Maker: Core Differences

| Feature | Market Maker | STP |

| Counterparty | Broker may internalize | External liquidity provider |

| Spread | Often fixed | Usually variable |

| Conflict Risk | Perceived higher | Perceived lower |

| Commission | Often built into spread | Spread + markup or commission |

| Slippage | Controlled internally | Reflects market conditions |

Understanding STP vs. market maker differences helps traders align expectations with execution behavior.

How Execution Models Affect Slippage

In trading you’ll always interact with slippage.

In market maker models:

- Slippage may be controlled or smoothed

- Requotes may appear

In STP/ECN models:

- Slippage reflects actual market liquidity

- No requotes in true ECN setups

Through this you’ll learn how slippage is a part of the trading system; it’s not any kind of manipulation.

Pricing Transparency and Order Flow

Transparency depends on the model you choose.

Market makers:

- Set their own price feeds

- Rarely show full market depth

STP/ECN:

- Shows real external liquidity

- Usually provides a deep market view

If you track order flow, then you get much clarity from STP or ECN setups.

Execution Speed Considerations

The speed of how your trade gets completed depends on:

- Server infrastructure

- Liquidity providers

- How your orders are sent

Due to a well-structured server, the market makers often give better results than STP, who lack proper structure.

Common Myths About Broker Execution Models Explained

1: Market Makers Always Trade Against Clients

That’s not true; you just need to know how to manage your risk.

2: STP Means No Slippage

False, even in STP you’ll see slippage when the liquidity shifts.

3: ECN Is Always Cheaper

Spreads look tight, but commissions still apply.

Understanding these models will help you avoid making false expectations.

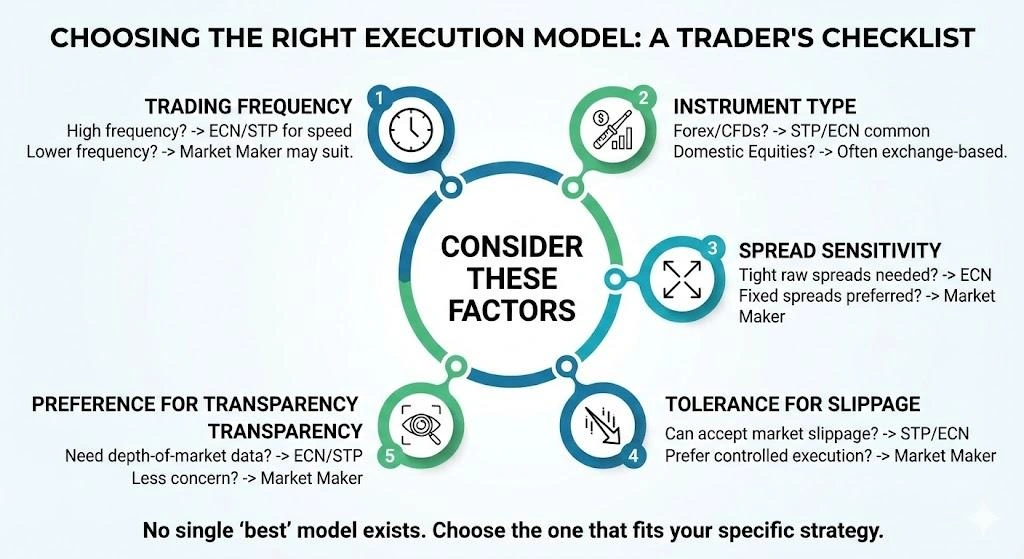

Choosing the Right Model

Before you choose between STP and market makers, you should consider:

- How often they trade

- Instrument type

- Spread sensitivity

- Slippage tolerance

- Transparent system

There might be no best model, but it can help you get the closest to the one that fits your specific strategy.

Tools to Evaluate Execution Quality

Traders can use:

- Slippage reports

- Spread comparison tools

- Execution speed metrics

- Order history exports

- Performance dashboards

These tools help you analyze your broker’s system and review your strategy.

Conclusion: Broker Execution Models

The broker execution model shows you exactly how your trade travels from your screen to the real market. The choice between STP and market makers impacts your spreads, slippage, and how much you trust the process. But when you understand how your orders are routed and where the money comes from, you pick out a broker that truly fits your strategy. To learn how to judge broker behavior, connect with Insightful Trade. By focusing on execution along with your strategy, you can achieve maximum.

FAQs: Broker Execution Models

1. What are broker execution models explained simply?

It’s just the way your broker handles and routes your orders, either keeping them or sending them out to global banks.

2. What is the main difference between STP and a market maker?

Market makers often take the other side of your trade internally, while STP brokers quickly pass your orders to banks providing liquidity.

3. Does STP eliminate execution risk?

No, even with STP you’ll still see things like slippage or widening spreads because these are just how the market behaves.

4. How should Indian traders evaluate brokers?

To evaluate your broker system, you should check the legal standing, how honest their trade fills are, the total cost, and their record-keeping habits.

Author: Kumkum Chandak

Experience: 3+ Years in Trading Research & Market Content Strategy

Kumkum Chandak is a trading content strategist and market research writer who specializes in simplifying technical analysis, trading tools, and strategy-driven educational content. Her work is optimized for EEAT, accuracy, and user intent, ensuring every article delivers practical insights for traders of all levels.

Risk Disclaimer:

All content is strictly educational and not financial advice. Trading involves substantial risk. Always perform your own analysis or consult a professional advisor.

Last Updated: 14 February 2026