Quick Summary

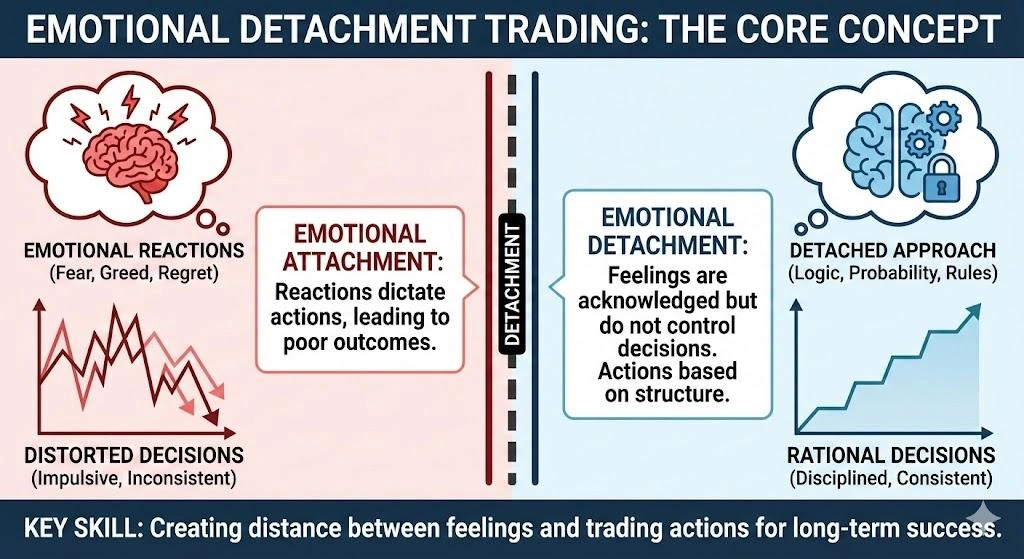

Emotional detachment trading is not about becoming emotionless. It is about creating distance between your feelings and your decisions so trades are based on logic, probability, and rules. This blog breaks down how emotions can cloud your judgement, how emotional detachment trading works, and ways traders around the world can keep their cool while staying disciplined even when the market gets intense.

At a Glance: Emotional Detachment Trading

| Aspect | Explanation |

| Core Problem | Emotional reactions distort trading decisions |

| Solution | Emotional detachment trading using rules & structure |

| Key Skill | Ability to detach emotions when trading consistently |

| Common Emotions | Fear, greed, regret, revenge |

| Best Tools | Journals, automation, predefined risk |

Introduction: Why Emotional Detachment Trading Matters

- Trading is a number game, but emotions seek certainty

- Most losses aren’t because of bad strategy; they happen because we let our feelings take over

- Staying disciplined isn’t about having a strong willpower; it’s about having a better routine

- The pro traders don’t obsess over the outcome; they focus on the process.

Understanding the Core Problem: Why Emotions Disrupt Trading

In trading, if your decisions are based on your instinct, then they’re not considered as trading but choices. And our brain is formed for survival, not for managing math and odds, which is why including emotions in your trading can feel like a rollercoaster ride.

When your money is on the line, the brain treats it like a life-or-death situation. Which triggers the fighting instincts that handle the basic fear and reward. This explains why traders often:

- Exit profitable trades too early due to fear

- Hold losing trades too long due to hope

- Overtrade after a loss to recover quickly

- Increase position size after a win due to overconfidence

Emotional detachment trading doesn’t mean you need to be a cold-hearted robot who doesn’t feel anything. You just need to avoid them while trading so that they don’t affect your result. To detach emotions while trading effectively, you just need to realize that feeling these emotions is natural, but acting on them is always a choice.

What Is Emotional Detachment Trading?

Emotional detachment trading means when you follow your trading strategies, not letting your emotions intrude on your trading.

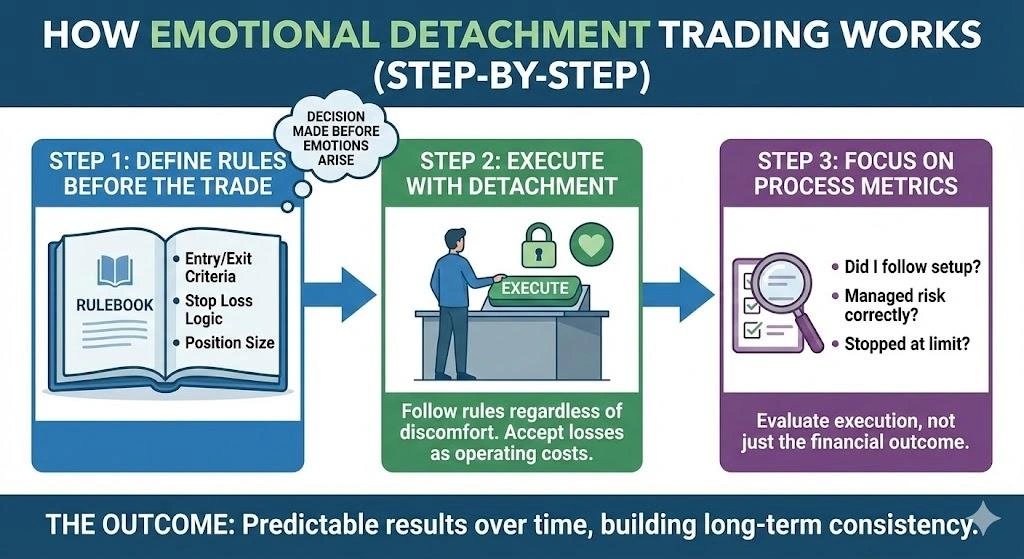

It means:

- Accepting losses as part of the system

- Not assigning personal meaning to wins or losses

- Evaluating performance based on execution, not outcome

- Treating each trade as one of many, not a defining event

It’s important to remember that emotional detachment trading isn’t about bottling up your feelings. If you try to suppress your stress, it’ll eventually explode into bad, impulsive decisions later. Real detachment means realising your feelings but choosing to follow your plan anyway.

Why Emotional Detachment Trading Improves Performance

1. Consistency Over Randomness

The market rewards the one who is consistent, not one who depends on luck. If your emotions are in charge, your trading becomes random and messy. Staying emotional detachment from trading helps you act the same way every single time, which is the only way to get predictable results.

2. Better Risk Management

Your safety rules only work if you follow them. When you keep your feelings out of the driver’s seat, you are much more likely to:

- Respect stop losses

- Maintain position sizing

- Avoid revenge trades

3. Clear Feedback Loop

It’s hard to learn if you keep making excuses. In emotional detachment trading, traders don’t blame the market for being unfair; they use data, analyse them and stick to their plan.

Common Emotional Traps That Emotional Detachment Trading Solves

Fear-Based Trading

Fear makes you exit a winning trade too soon or freeze up when it’s time to enter. Emotional detachment trading means you acknowledge that nervous feeling but treat it like a simple data point, not a command to act.

Greed-Based Trading

Greed is that voice that tells you to take more trades or to ignore exiting as per your rules because the trade is still moving up. But you can avoid this feeling by setting profit targets and daily limits before you even start.

Revenge Trading

After a loss, it’s very natural that you want to avenge and win your money back right away. Emotional detachment training stops this by enforcing a cooling rule forcing you to stay away until you are calm again.

Confirmation Bias

Emotionally attached traders seek information that supports their position. Detached traders stick to price and rules.

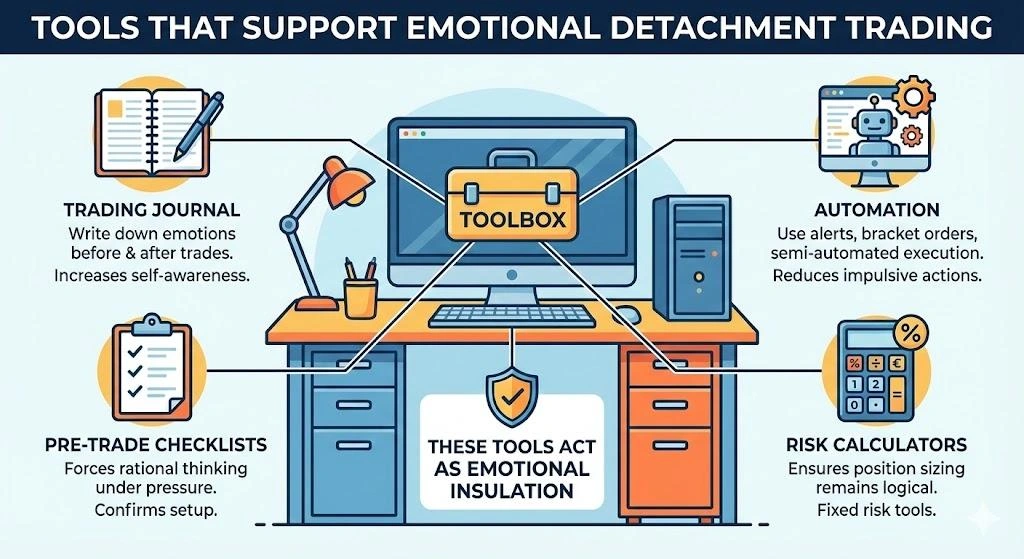

Tools That Support Emotional Detachment Trading

Trading Journal

Writing down your feelings builds awareness. When you recognize an emotion, it loses its power over your action.

Automation

Using alerts and automatic orders stops you from making panicked entries or exits.

Checklists

A quick pre-trade checklist that forces your brain to stay logical when the pressure is high.

Risk Calculators

Calculators keep your trade size based on the math, not on how lucky you feel today.

Emotional Detachment Trading in the Indian Market Context

Indian traders face unique emotional challenges due to:

- High retail participation

- Social media tips and noise

- Intraday leverage temptation

To detach emotions trading in Indian markets:

- Ignore the tips on Telegram/WhatsApp

- Follow SEBI-compliant brokers and tools

- Trade defined time windows

- Maintain proper trade records

Staying calm and following a process isn’t just good for your account; it’s also the kind of disciplined, transparent approach the Indian regulators want to see.

Compliance and Discipline: Why Emotional Detachment Trading Helps

Regulators mainly focus on these things:

- Risk awareness

- Documentation

- Non-misleading practices

Traders who stay calm find it easy to stay on the right side of these rules. They:

- Keep a journal

- Avoid impulsive leverage

- Follow defined strategies

This is especially important if you’re sharing your results publicly or using professional tools.

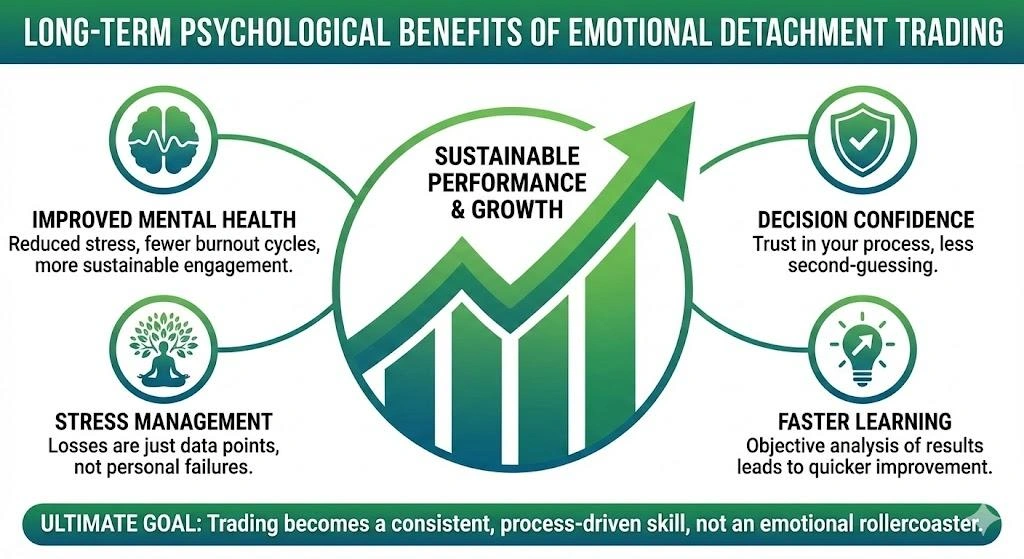

Long-Term Psychological Benefits of Emotional Detachment Trading

It’s not just about money, but having your feelings in check makes your whole life as a trader much easier:

- Mental health

- Decision confidence

- Stress management

- Learning speed

Traders who detach emotions from trading don’t burn out. They keep showing up day after day because they aren’t exhausted by the emotional rollercoaster.

Common Myths About Emotional Detachment Trading

Myth 1: You Must Be Emotionless

Reality: You don’t need to be emotionless; you just need to recognize your feelings without letting them control you.

Myth 2: Experience Alone Creates Detachment

Reality: Time alone isn’t enough to fix this; having a solid plan and a routine is important to create that chill factor.

Myth 3: Detachment Reduces Motivation

Reality: It’s the opposite. Clearing out the emotions increases clarity and focus.

Conclusion: Emotional Detachment Trading Is a Skill, Not a Trait

No one is born perfect in trading. It’s a skill that you developed over time through a solid routine, plenty of practice, and being honest with yourself. When you learn to keep your feelings to yourself, your decisions improve, you manage your risk effectively, and you start learning from your mistakes faster.

Platforms like InsightfulTrade focus on guiding new traders with the mental game, because staying calm and following the process is the only way to survive and thrive in the market for a long time.

Frequently Asked Questions (FAQs)

1. What tools help with emotional detachment trading?

Keeping a journal, using a clear set of rules, setting price alerts, and using a calculator for risk management help you stay focused on the charts instead of your emotions.

2. Is emotional detachment trading suitable for beginners?

Yes. It’s best to start early before they become bad habits. Learning to stay detached from day one saves you from a lot of stress and expensive mistakes later.

3. Is emotional detachment trading relevant in Indian markets?

Absolutely. With the wild price swings and high stakes we see in India, keeping a level head is the only way to survive for the long term.

4. Does SEBI require emotional detachment trading?

SEBI doesn’t have any mandatory rule, but staying detached helps you follow your rules, like managing your risk properly and keeping your paper in order.

5. Can automation fully replace emotional detachment?

Automation takes the weight off, but you still need to develop emotional awareness to handle exceptions and system failures.

Author: Kumkum Chandak

Experience: 3+ Years in Trading Research & Market Content Strategy

Kumkum Chandak is a trading content strategist and market research writer who specializes in simplifying technical analysis, trading tools, and strategy-driven educational content. Her work is optimized for EEAT, accuracy, and user intent, ensuring every article delivers practical insights for traders of all levels.

Risk Disclaimer:

All content is strictly educational and not financial advice. Trading involves substantial risk. Always perform your own analysis or consult a professional advisor.

Last Updated: 13 January 2026